Opportunities continue to be abundant in the health care sector. Because the demand for services is great, competition between health care providers is extremely keen. Every company or system is eager to capture more market share, and that is generating thousands of contracting opportunities for other companies. In 2018 alone, 12 hospital systems announced construction projects with cost estimates exceeding $1 billion each.

Because health care groups are competing so aggressively, they are interested in new or upgraded facilities, top-of-the-line equipment, user-friendly websites, and leading-edge technology. They also want to lower operating costs, so there is interest in services that offer more efficiency or cost reductions – energy audits, outsourced equipment maintenance, and comprehensive facility services that include everything from security to landscaping. Many 24-hour health care clinics and emergency centers want LED lighting for parking areas and upgraded technology that facilitate faster check-in time. Hospitals and health care facilities also purchase marketing assistance, fundraising expertise, and public relations services.

Every midsize to large city wants top-tier hospitals, and increasingly city leaders are incorporating health care facilities into urban redevelopment plans. That’s because hotels and restaurants follow hospitals, and the retail establishments enhance the tax base.

On the flip side, economic and societal changes are affecting health care services in rural areas. Many less-populated areas are losing hospitals, clinics and health care providers. A recent study sponsored by the University of North Carolina’s Center for Health Services Research found that nearly 700 rural hospitals are at risk of closing because of funding challenges. These regions are seeking telehealth and telemedicine services. To facilitate those capabilities, many smaller cities and counties are announcing contracting opportunities for the last mile of broadband access, and numerous federal programs are allocating funds for such projects.

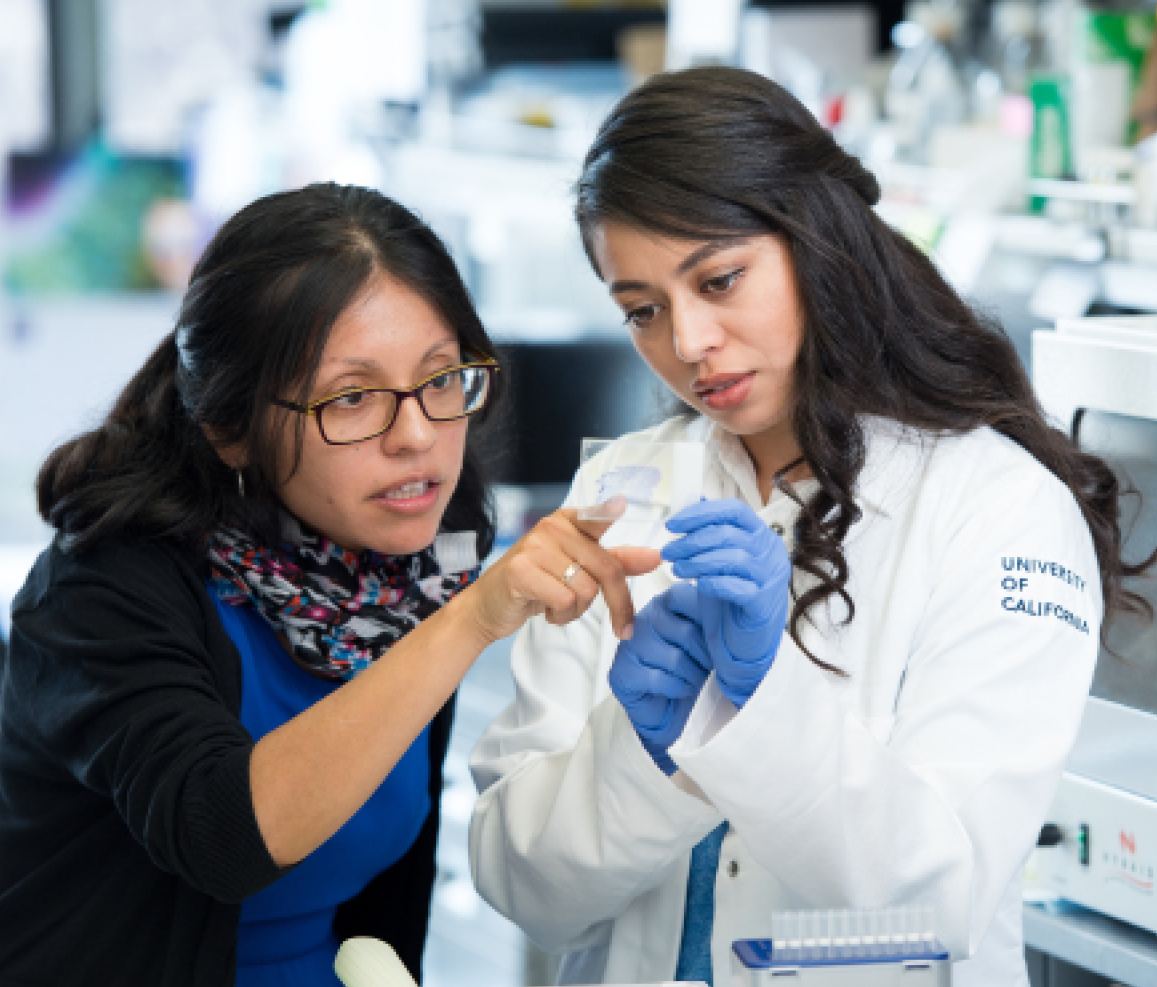

Upcoming opportunities related to health care can be found in every state and region. In 2018, the University of California, San Francisco announced plans to build a $1.5 billion hospital to replace an aging, outdated facility. The old facility no longer met seismic code requirements and had outdated HVAC systems and equipment. It could not accommodate electronic records or modern imaging equipment. A replacement facility will be a part of a revitalization project for the university’s Parnassus Heights campus.

Recently, officials at the Texas Medical Center in Houston released a design for a 37-acre research campus. The project combines collaborative research facilities with shops, restaurants, residences, and offices as well as parks and plazas. The project, called TMC3, is designed to be a collaborative effort of five major university research centers. The first building will be a 250,000-square-foot research facility with an estimated cost of $246 million. More buildings will follow, including an office space to house private health care companies, a hotel, a conference center, and residential projects. The city hopes the area will become a landmark and destination site that attracts people interested in art, music, and entertainment as well as health care services.

The Louisiana State University board of supervisors is planning a long-term lease and redevelopment project that will renovate an old hospital damaged by Hurricane Katrina in 2005. Plans call for converting the facility into mixed-use housing and an office complex. Tulane University is only one of many potential tenants. The plan is for the project to be a public-private partnership initiative.

The University of Minnesota issued a request for proposals in early May for a feasibility study related to construction of a new microbial cell production facility. The proposed facility will be located near the Biotechnology Resource Center on the St. Paul campus. University officials anticipate an August 31 deadline for the study. Construction opportunities will be announced shortly after that.

Legislators in the state of Washington approved more than $118 million in funding for hospitals across the state. Eastern State Hospital, a psychiatric hospital, will get $19 million for infrastructure upgrades, including a new boiler plant, fire safety systems and heating and ventilation monitoring. Lakeland Village, a state-operated, 283-bed care facility for individuals with intellectual and developmental disabilities, will receive about $5 million for infrastructure improvements with a focus on the facility’s electrical system. Roughly $33 million is dedicated to design work for a new 150-bed behavioral health teaching hospital at the University of Washington in Seattle. More funding is allocated for predesign of another facility for the university’s Behavioral Health Institute at Harborview Hospital.

In May, the governor of Montana signed nine bills that allocate funding of about $400 million for state infrastructure projects. This includes $4.5 million for sewer replacement at the Montana State Hospital in Warm Springs as well as $4.25 million for a dental hygiene lab at Great Falls College.

The governor of Virginia recently announced plans to rebuild a 150-year-old Central State Hospital in Petersburg. The project is just one part of a larger plan to increase the state’s access to mental health care. The state plan will add about 300 more beds and consolidate and upgrade other health care facilities as well. Legislators in Texas are also in the process of allocating large amounts of funding for complete renovations of several state hospitals.

Upcoming contracting opportunities of all sorts and sizes are being announced each week. The U.S. health care industry is robust, and it will impact the country’s economic vitality in a very good way.

Strategic Partnerships, Inc. is one of the leading procurement consulting companies in the U.S. Contact them today to learn how to increase your public sector sales.